Experts predict 2023 food tech trends

Where is the plant-based market heading? Will cultivated meat arrive at a restaurant near you? See what insiders predicted - and you can play along!

I am trying something new for this year’s prediction season.

I asked 50+ top alt protein experts, insiders and investors several questions about the market in 2023.

But instead of simple yes/no answers, they had to assign a probability value to specific outcomes and take an educated guess on the market size. I then put together all this data to come up with “the wisdom of the (expert) crowd” results.

Over 35 experts took a survey, leading to a solid representation of the sector’s most active investors (AgFunder, Agronomics, BIV, Blue Horizon, CPT, FoodLabs, SOSV, Unovis and others) and organisations (APAC-SCA, Food Frontier, GFI and more).

There is a diversity of perspectives, with responders from all key geographies, various backgrounds, and near-perfect gender parity (see footnotes for a full list of names1).

Before we jump into experts’ predictions, you can actually try it for yourself.

Click here to open the same survey the experts took.

If I get enough replies from my readers, I will update this article, adding a “community prediction” next to industry insiders. Maybe I can even pick “the most accurate forecaster” when the actuals are known in early 2024?

[Updated Feb 11th: I now added a wider food/tech community predictions2 from 100+ readers, social media followers etc.]

If you took a survey and discovered you are really into this, I recommend the “Superforecasting” book and the Metaculus forecasting platform, both of which have been an inspiration for me here.

Few more notes about this exercise:

Each question had a specific set of base assumptions and in some cases historical figures for context (see the full survey in PDF here)

The expert group include investors with a thesis focused on the alt protein sector and senior members of various organisations, often with a mission to promote the industry - in other words, prone to bias; to minimise biases, no individual responses are not linked to specific names; as you will see in anonymised “answer distribution” charts, some experts are indeed optimistic, but there are many sceptics and realists too

For probability and numerical questions, median values worked out to be very close to the mean - for better readability, I only included the former.

Last but not least, make sure you read till the end for the accountability check of my own 2022 APAC alt protein predictions from a year ago. I also added the list of events I am attending, including the US food tech circuit I am planning for March.

OK, let’s get to expert predictions, starting with a meaty one…

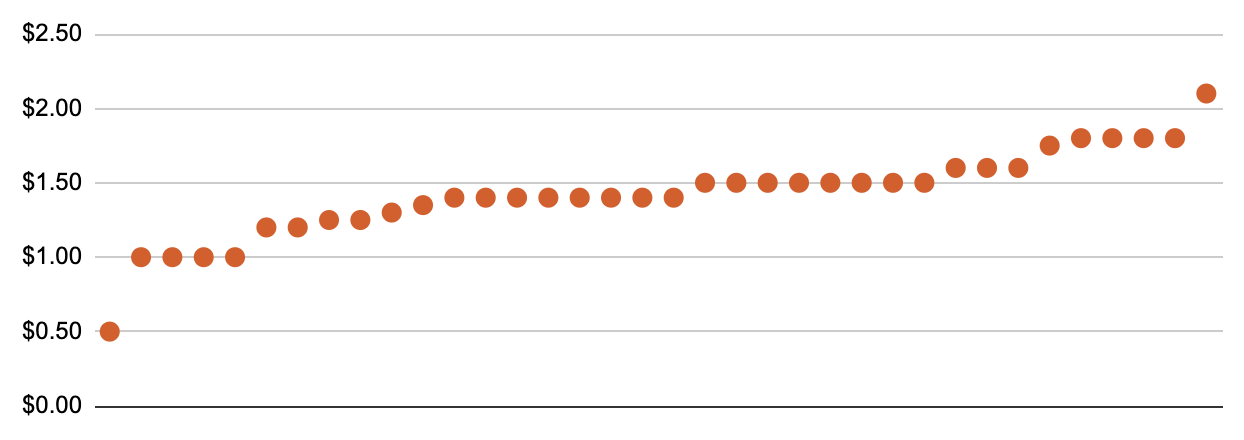

What will be the value of retail (supermarket) sales of plant-based meat in the United States in 2023?

Experts’ prediction (median): US$1.40 billion

Community prediction: US$1.40 billion, same as experts

The plant-based meat market has become a hot topic recently.

Bloomberg Businessweek published a widely discussed article with a catchy, or rather clickbaity, a title suggesting fake meat might be just another fad. I published my response here. Also, check the November issue of this newsletter for a deep dive into this subject.

In my prediction survey, I asked experts for their forecast of the plant-based meat retail sales value in the US in 2023 (I would obviously prefer a global figure, but there is not enough reliable data for most markets).

Some of them believe it will drop further, and some foresee (mostly modest) growth this year. The median answer of US$1.4 billion is exactly the same as the actual sales figures in 2020 and 2021:

(I do not have full 2022 numbers yet, but towards the end of the year the retail sales of the category were down -3.8%, according to IRI via FoodNavigator)

In other words, experts as a group predict the US plant-based meat retail market will remain basically flat in 2023.

Note that the food service (restaurant) channel is not included. Why? It is very hard to come across reliable market sizing, even for the US (if any of my readers has good data on this, let me know).

Next up, questions about cultivated meat and precision fermentation.

Will Singapore approve a product from another cultivated meat or seafood company in 2023?

Experts’ prediction (median): 80% probability

Community prediction: 80% probability, same as experts

In late 2020, Singapore became the first country to approve a cultivated meat product to be sold to consumers.

The approval went to Eat Just - a startup headquartered in San Francisco - for a cell-based chicken nugget product, branded GOOD Meat.

Since then, Singapore Food Agency (SFA) green-lighted several other variants and form factors of cultivated chicken products from the same company, and most recently serum-free production process (growing cells for current GOOD Meat products requires FBS - or foetal bovine serum - the blood of cow foetuses harvested by slaughtering pregnant cows, which Straits Times rightly calls “both ethically controversial and expensive”).

Singapore is still the only country where cultivated meat passed all stages of regulatory approval and can be purchased by consumers - currently, in small quantities once a week at Huber’s Butchery.

And so far all of it is from a single company.

Will this change in 2023 - are any cultivated meat or seafood products from other startups going to be approved by SFA? The expert group gives it an 80% chance.

It makes sense that experts would mostly assign high probability here (all but one answer is 50% or higher and the majority is 75% or higher). My sources are suggesting there are at least 10 startups at various stages of the talks/process with SFA.

Some companies shared publicly their intention to manufacture and/or launch in Singapore.

Dutch startups Mosa Meat (beef) and Meatable (pork) announced partnerships with Esco Aster, which in 2021 became the first facility to obtain regulatory clearance to produce cultivated meat products in Singapore. Meatable also partnered with a local plant-based butcher Love Handle to co-develop hybrid products.

Israeli startup Aleph Farms and Australian Vow3 both openly talk about launching their cultivated meats in the country first. Some China-based companies are also eyeing the market as they expect regulatory approval in the mainland to take more time.

There is also a growing number of local startups, in the cell-cultured seafood (Avant Meats, Shiok Meats, Umami Meats) and cultivated meat (Gaia Foods - which is now merged into Shiok Meats, Meatiply), some of which already have kicked off the regulatory process with SFA.

Will cultivated meat or seafood be sold to consumers in the US in 2023?

Experts’ prediction (median): 70% probability

Community prediction (median): 51% probability

In this case, experts are divided. A sizeable group (about 1/5) gave it a pretty low chance, well under 50%. A larger cohort (over 1/3) assigned a probability of over 75%. The median result is 70%.

In November 2022, the U.S. Food and Drug Administration (FDA) gave a “safety blessing” to the first cultivated meat product - a chicken made by a California startup UPSIDE Foods.

It is a key milestone for the company and the market, but the "No Questions" letter from FDA is not enough for UPSIDE to start selling its product to consumers in the US. It still needs approval from the U.S. Department of Agriculture (USDA). In 2019 both agencies agreed to jointly regulate cultivated meat and poultry. The USDA website has a detailed description of the process. UPSIDE confirmed it will “now work with the USDA's Food Safety and Inspection Service (FSIS) to secure the remaining approvals”.

It is likely that the first venue to sell UPSIDE’s cultivated chicken post-approval will be a three-Michelin star San Francisco restaurant Atelier Crenn. The company partnered with chef Dominique Crenn in 2021.

My sources tell me that at least 3 other startups are in the question-and-answer stage with FDA and are likely to receive similar “No Question” letters soon.

According to a recent interview, one of them is Wildtype, working on cell-cultured salmon.

Interestingly, in the US, FDA is the only agency regulating seafood. USDA approval is not required for virtually all cell-based seafood (as explained on the USDA website here). In other words, Wildtype and similar startups should be allowed to sell their fish or seafood products to consumers as soon as they get a green light from FDA.

The same “FDA only” principle may apply to some hybrid products using ingredients like cultivated fat, although it is less clear from the publicly available guidance.

Given a wide range of answers from experts, some seem to believe things will move slow-ish with USDA’s approval for UPSIDE. They also may think FDA will take their time with approvals of cell-cultured seafood or fats. It is also possible that some experts, especially those less exposed to the US market, are not aware of the nuances of the dual-agency regulatory framework.

Which one of the following markets is the most likely to approve cultivated meat or seafood in 2023?

We covered Singapore and the US - but which country will be next?

The majority of surveyed experts believe Israel is the most likely one to issue regulatory approval for cultivated meat and/or seafood in 2023.

Israel is one of the top global hubs for startups working on this technology. The best-known and best-funded are Aleph Farms, Believer Meats - previously known as Future Meat Technologies - and SuperMeat. Together they raised over US$580m in funding. Overall Israeli cultivated protein startups received ~36% of global VC funding in the sector by mid-2022, according to GFI Israel’s report.

I am not that familiar with the Israeli market, but I heard mixed signals coming from the local ecosystem when it comes to regulatory approval. Some insiders seem to believe it will take more time. It is possible that the Israeli food regulators prefer to wait for FDA/USDA to fully allow it first. The moves by top local startups give a hint too - Aleph is pursuing Singapore’s approval, while Believer Meats is building a large manufacturing facility in the US.

In Asia, South Korea and Japan are known to be working on the regulatory framework and between them, they received ~22% of expert votes.

Other markets with single or double mentions are China, European Union, United Arab Emirates and Qatar (Eat Just / GOOD Meat is planning to build a factory there).

Several experts said they think the approvals in markets other than Singapore and the US will only come in 2024 or even 2025.

To finish up the regulatory part, let’s look at precision fermentation:

Will a precision fermentation protein or fat product from at least one more company be approved anywhere in the world in 2023?

Experts’ prediction (median): 77% probability

Community prediction: 75% probability

As of early 2023, three startups have publicly announced receiving regulatory approvals for their precision fermentation-derived proteins: Perfect Day and Remilk for animal-free whey (or more precisely β-lactoglobulin) and The EVERY Company (formerly Clara Foods) for animal-free egg white protein.

All three have received Generally Recognised As Safe (GRAS) designation from FDA in the United States. Perfect Day also got approved last year by Singapore Food Agency. They have all started to sell some products to consumers and/or partner with various third parties, including big food: Bel, General Mills, Mars and Nestlé.

There is a number of precision fermentation startups in line for more approvals.

Some are working on animal-free whey and/or casein protein, a crucial component in making cheese: All G Foods (Australia), Better Dairy (UK), Change Foods (US/Australia), Changing Biotech (China), Formo (Germany), Imagindairy (Israel), New Culture (US), Phyx44 (India) and more.

Others are pursuing fats, aiming to take plant-based meat products to the next level with animal-like lipids: Melt&Marble (Sweden), Nourish Ingredients (Australia), Yali Bio (US) and more.

Experts have high confidence that in 2023 one of those will receive regulatory approval somewhere in the world - their median probability score is 77% - with all but two folks selecting 50% or higher.

The regulatory bar seems to be lower for precision fermentation compared to cultivated meat - the process is generally simpler/quicker (e.g. Perfect Day got the first approval in ~10 months from the submission) as the tech has been previously applied to other food ingredients.

The last section of the prediction survey has to do with funding for the sector.

How much money will investors put into alternative protein startups in 2023?

Experts’ prediction (median): US$2.93 billion

Community prediction: US$2.96 billion

Wide range of experts’ guesstimates again - from US$1.26 billion on the low end all the way to over $6 billion!

This one is particularly difficult to forecast. The markets changed dramatically in 2022 with VC funding across all sectors, not just food tech, down 35% for the full year according to Crunchbase and -63% in Q4 alone (via KPMG).

Will the VC funding drop even further in 2023 or start to recover - and how fast?

I do not yet have the final Q4 data for the alt protein sector. For Q1-Q3 confirmed figure based on PitchBook via GFI is $2.2 billion. My best estimate is that in 2022 total alt protein funding was in the $2.5-3.0 billion range.

That compares to a peak of $5.1 billion in 2021 and $3.1 billion in 2020.

The median prediction by experts works out to be $2.93 billion for 2023. To get there, the funding would have to recover from the levels observed in the second half of last year. Or alternatively, dip more in Q1/Q2 and then pick up sharply later in 2023.

In just a few weeks, the detailed 2022 alt protein funding data should be available - with breakdowns per technology and per region. My next newsletter will be a deep dive into the sector funding - if you do not want to miss it, make sure you subscribe:

What share of the total money invested in alternative protein will go to Asia Pacific-based startups in 2023?

APAC-based startups received just 5-7% of global alt protein funding in 2020 and 6-8% in 2021 (based on PitchBook/GFI and public announcements).

That share has grown to an estimated 18-22% last year.

It is a big shift, but APAC startups are still underinvested compared to the region’s share in the total protein market. Over 40% of meat and over 70% of seafood is consumed in Asia Pacific. It is the largest protein market in the world and the fastest growing.

Experts that took a survey predict a further increase in APAC’s share in 2023 to a median of 25%. Very few believe the numbers will go much further. It seems realistic - catching up will likely take several years.

How about exits in 2023? Will there be any major IPO?

Will an alternative protein company go public with at least a US$1 billion market capitalisation in 2023?

Experts’ prediction (median): 30% probability

Community prediction: 24% probability

No surprise here - according to experts, there is an overall low probability of an alt protein company going public in 2023 with a US$1B+ market cap.

The tech IPO market plummeted 94% in 2022 according to Ernst & Young’s report from mid-Dec, reported CNBC.

Companies are postponing public offerings if they can afford to wait, staying private longer, conserving cash or raising bridge rounds from private equity. That includes well-funded alt protein startups that previously were rumoured to plan the IPO - Impossible Foods and Eat Just.

Still, there are some optimists among surveyed experts - 1 in 4 said a chance for a major IPO this year is >50%.

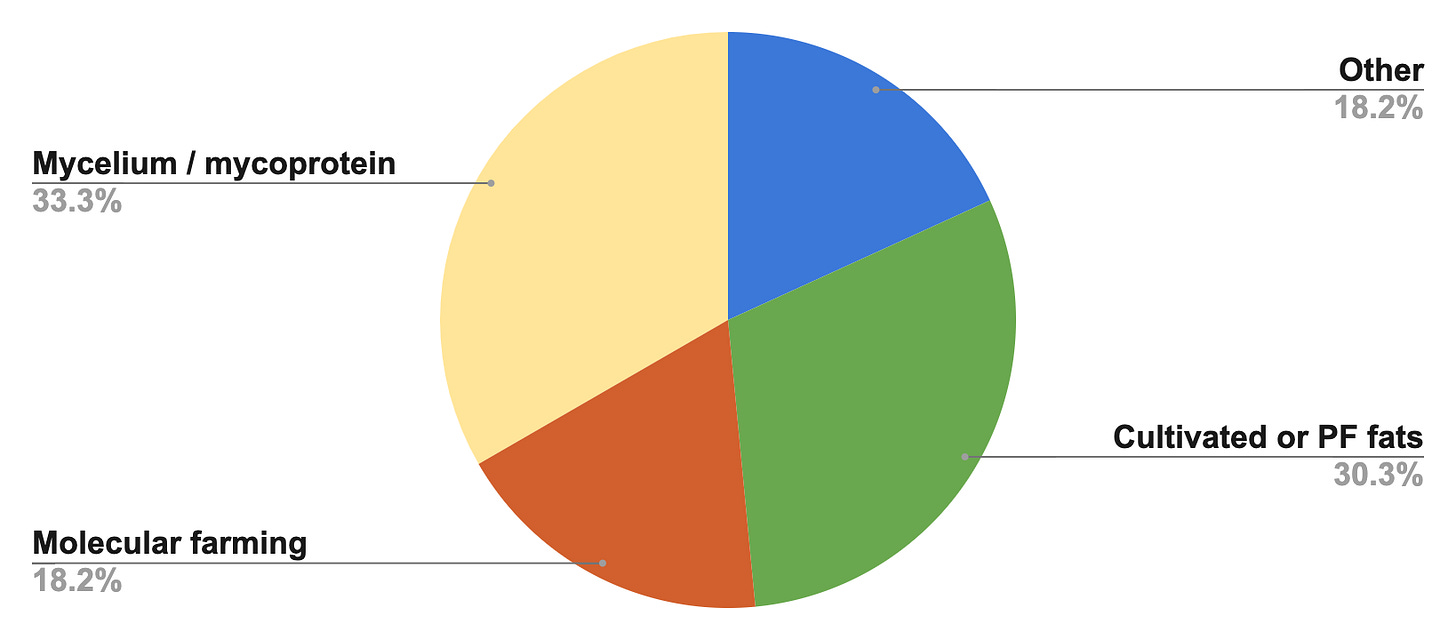

Bonus: which new technology will have the biggest impact on the industry in 2023?

Experts’ predictions:

Community predictions:

Cultivated/PF fats - 37.8%

Mycelium/mycoprotein - 27.6%

Microalgae - 11.2%

3D printing - 9.2%

Molecular farming - 4.1%

Other - 11.1%

A bonus question I asked at the very end of the survey was about new technologies experts see as the most impactful in 2023.

What excites them and gives them goosebumps?

The top pick is mycelium (mycoprotein), selected by 1 in 3 experts.

No wonder - it is a tech that is ready to scale, built around a fairly recognizable “natural” ingredient (one of the leading startups, Meati, uses a consumer-friendly term mushroom root). It is not without challenges but can help solve some of the issues of the current plant-based meat related to nutrition, taste, texture etc.

The next most popular expert choice is cultivated and precision fermentation fat. These are promising technology platforms to replace often sub-par oils (coconut, sunflower) used in the current generation of plant-based products. Cultivated/PF animal-like fat might be one of the solutions to the “plant-based sensory gap”.

Molecular farming also got a sizeable group of believers. It is an interesting alternative to precision fermentation, using plants as bioreactors to make proteins like casein or even growth factors for cultivated meat. Nice overview of the molecular farming tech in this episode of Red to Green Food Tech podcast, featuring Amos Palfreyman of Miruku.

Honourable mentions (each earning one vote): 3D printing, air (CO2) protein, shear cell, fiber spinning and cultivated media innovations.

2023 is shaping up to be another interesting year in the world of alt protein. I will check back in early 2024 to see what experts got right/wrong.

Before I forget, let’s look back at my own last year's predictions for the APAC alt protein market. I want to hold myself accountable!

Here are 5 things I said a year ago:

1. Precision and biomass fermentation on the rise 🦠

That one turned out mostly correct.

Historically, a very small % of global fermentation investments went to APAC-based startups. I argued it will start changing in 2022, given all crucial components are here in the region: talent, scale-up facilities etc.

Indeed, we have seen several large funding rounds for precision fermentation - Changing Biotech in China, All G Foods, Change Foods and Eden Brew in Australia - as well as early-stage funding for startups like Daisy Lab (NZ) and Phyx44 (India).

Top-funded global precision fermentation company Perfect Day launched several products in Singapore and acquired a factory in India for nearly US$80m to boost the scale-up efforts.

APAC’s biomass fermentation sector, specifically mycelium, is still behind the rest of the world. There are some pioneering startups but too few and hardly any that received substantial funding yet. The good news is, judging from the number of pitch decks mentioning “mycelium” or “fungi” that landed in my inbox lately, things are finally starting to change.

2. More cell-based action in Singapore 🧫

It was a rather easy (lame?) prediction based on a pretty obvious trend.

Clearly, there has been “more cell-based action” in Singapore last year:

New local startups emerging from stealth and/or presented their first prototypes (Meatiply, Umami Meats).

The first multi-company semi-public tasting of cultivated meat products.

Eat Just / GOOD Meat rolling out new cultivated chicken products, organising several hawker pop-ups and partnering with a premium butchery.

Singapore Food Agency approving a serum-free production process.

And as previously mentioned, plenty of local and global contenders for the title of the second startup to have a product approved for sale to consumers.

3. Alt-seafood wave 🌊

Not quite what I was hoping for - more of a splash than a wave in 2022.

While cell-based seafood startups made progress last year, showing new prototypes (Umami Meats’ fish ball, CellMEAT with their doko shrimp), there are almost no new plant-based seafood products on the market, with the notable exception of a few SKUs from Thai Union.

APAC is the world’s largest seafood producer and consumer, and I really hope to see more alt-seafood startups and products in the region this year.

4. APAC startups raising nine-digit rounds 💰

What I then called an “easy prediction” turned out to be the trickiest.

At the beginning of 2022 it was hard to see clearly the extent of upcoming correction in VC funding (not just for alt protein, but in general).

By end of Jan 2022, two startups in APAC announced $100m rounds (Starfield and Next Gen Foods) and at least two more were rumoured to be raising at similar levels. While that has not succeeded, we have still seen several sizeable rounds announced later in the year: in August, US$65m Series A of an oat milk startup Oatside and in November $49.2m for Vow, the largest Series A for cultivated meat startup globally.

More on the largest funding rounds of the last year in my next newsletter - stay tuned.

5. Geos to watch in 2022: Indonesia, SEA, India 🌏

There were some interesting developments in those markets in 2022.

Indonesia is home to two prominent alt-meat and alt-dairy startups: Green Rebel Foods and Oatside, both manufacturing in the country and expanding throughout the region. More startups are emerging, with OFF FOODS and Meatless Kingdom announcing funding rounds.

Other South East Asia emerging markets are less active so far - we need more alt protein startups in Thailand, Malaysia, Philippines, Vietnam and others.

India has one of the highest numbers of early-stage alt protein startups in APAC, and a few of them raised seed funding last year - among them Alt Co, Greenest, Phyx44, Shaka Harry, Sudo Foods. Local companies got investments and endorsements from top Bollywood and sports celebrities. And a unicorn premium meat brand Licious launched a line of plant-based products.

Overall, with at most 3 out of 5 correct, I did not do all that well 🤦 This prediction business is hard!

As usual, thanks for reading and let me know what you think. Feel free to share this with someone you think might enjoy it.

🎟️ Events I am attending

New Food Invest Conference Asia Pacific (Virtual, February 15th), co-hosted by ProVeg International and Beyond Animal

I will be speaking at 1 pm SGT on a panel about alt protein investments in Asia

The Future Food-Tech Summit (San Francisco, March 16-17th)

One of the top industry events organised by Rethink Events

Future Food Now newsletter is a media partner

While in the US, I am also planning to visit Expo West in LA and SXSW in Austin - cannot wait to catch up with industry folks and try some new great products!

Full list of experts who responded: Dalal AlGhawas (Big Idea Ventures), Elysabeth Alfano (VegTech Invest), Arman Anatürk (FoodHack), Ugo Bataillard (GourmetPro), Lewis Bollard (Open Philanthropy), Anthony Chow (Agronomics), Nate Crosser (Blue Horizon), Varun Deshpande (GFI India), Stephanie Dorsey (E²JDJ), Lesley Farrah Dorwling-Carter (CPT Capital), Daniel Eichner (SOSV), Lisa Feria (Stray Dog Capital), Sonalie Figueiras (Green Queen Media), John Friedman (AgFunder), Bruce Friedrich (GFI), Gautam Godhwani (Good Startup), Mirte Gosker (GFI APAC), Matilda Ho (Bits x Bites), Mariliis Holm (SFV), Patrick Huber (FoodLabs), Felipe Krelling (Newbio VC), Susie O'Neill (Food Frontier), Anna Ottosson (Trellis Road), Macy Marriott (GlassWall Syndicate), Steven Molino (Clear Current Capital), Simon Newstead (Better Bite Ventures), Sam Perkins (Cell Ag Australia), Kristen Rocca (Unovis), Daniel Skaven Ruben (FoodTech Weekly), Claire Smith (Beyond Impact), Liz Specht (GFI), Jennifer Stojkovic (Vegan Women Summit), Albert Tseng (Dao Foods), Albrecht Wolfmeyer (ProVeg), Samantha Wong (Blackbird), Peter Yu (APAC-SCA)

I am not listing all participants of community voting; it got a total of 101 votes sourced via this substack, several other food and food tech newsletters/publications and my social media channels, mostly LinkedIn; some votes came in before expert results were published, the bulk of them after, so participants could get influenced by experts’ opinions; 27+ countries from all continents except Antarctica were represented

Disclosure: in my role as Foundering Partner of Better Bite Ventures and an angel, I am an investor in some of the companies mentioned in this piece: Change Foods, Green Rebel Foods, Greenest, Meatiply, Miruku, Phyx44, Shaka Harry, Umami Meats, Upside Foods, Vow