I am writing this from California, my first trip here since the pandemic. Many people to meet and products to try - but I somehow managed to put this piece together in between meetings and tastings!

The recently released alt protein 2022 funding report by Good Food Institute (GFI) based on PitchBook figures has the most comprehensive data on the alt protein sector’s funding (obviously no source is perfect, see caveats and limitations footnote1).

I will unpack and contextualise the data. Hope you like charts, because there are quite a few in this one :)

Let’s start from the very top: US$2.9 billion has been invested in alternative protein startups in the full year 2022.

Here is the trend over the last 12 years, starting almost literally from zero:

No surprise: the funding has dropped compared to 2021 when alt protein startups raised a record $5.1 billion. In 2020, it was $3.1 billion.

I was curious to see how this ~42% drop compares to the overall VC funding and other verticals. Here is a quick rundown (all year-on-year for full 2022, various sources2):

Alt protein: -42%

All VC funding: -35%

Agri-food tech: -44%

Biotech: -29%

Carbon & emission tech: -2%

Climate tech: -3%

Fintech: -46%

The picture is pretty clear - the alt protein funding is mostly following what is going on in the venture capital world more generally.

Food tech investors and experts also point to macro trends affecting VC/PE. Christian Guba, Principal at FoodLabs told me:

It is almost exclusively [driven] by macroeconomic factors. The zero-interest world [before 2022] has led to significantly more VC funding across all verticals, including alt-proteins.

Gautam Godhwani, Managing Partner of Good Startup agrees:

This sector is not unique – overall venture capital funding fell [significantly] compared to a year ago.

Sonalie Figueiras, founder of Green Queen Media talks about the more conservative approach in the new macro reality:

Rising interest rates, growing inflation and a potential recession mean investors are far more cautious.

They do however believe that the stagnation of plant-based sales (which I have covered previously) as well as regulatory and scale-up hurdles also contributed to the drop.

I noticed that the funding for some sectors of the broad “climate tech” category (renewable energy, climate management and carbon removal/capture) has been growing - or at least remaining fairly flat.

That inspired me to check how alt protein funding stacks up in a broader climate tech context. It turns out it has been of the top-funded subcategories in 2020-2022, on par with Autos (mostly EVs) and Batteries, at least according to one source:

Overall ~11% of $100 billion climate tech funding in the last 3 years went to alt protein.

Is it enough? Some believe the sector is greatly underfunded - the recent report from The Rockefeller Foundation and Boston Consulting Group suggests that “over $40 billion in annual investment [in alternative protein] will be needed to stimulate and sustain adoption”.

A more detailed quarterly view of alt protein funding shows how much of the outlier 2021 has been, especially the second half:

That is broadly in line with overall VC funding, which peaked in Q4 2021 and dropped every quarter since (more details in this Crunchbase article).

Digging deeper - which alt protein technologies attracted the most funding in 2022?

Plant-based startups got $1.2 billion, -41% year-on-year

Cultivated (cell-based) = $896 million, -33% YoY

Fermentation (biomass and precision) = $842 million, -50% YoY

In 2019-2020 plant-based startups dominated, receiving ~70% of the industry funding. In the past 2 years, cultivated and fermentation companies got ~60% of total dollars.

But possibly the biggest story of 2022 alt protein funding is the geographical shift, best illustrated by this chart from GFI (yellow bar = North America):

For the first time, most alt protein investments went to non-American startups.

The trend has been clear for a while, but it accelerated in 2022 - with 58% of venture funding going to companies in Europe, APAC, LatAm and MENA.

Here is what it looks like per region:

You will notice that funding in the US dropped significantly (-63%), while Europe and APAC are up.

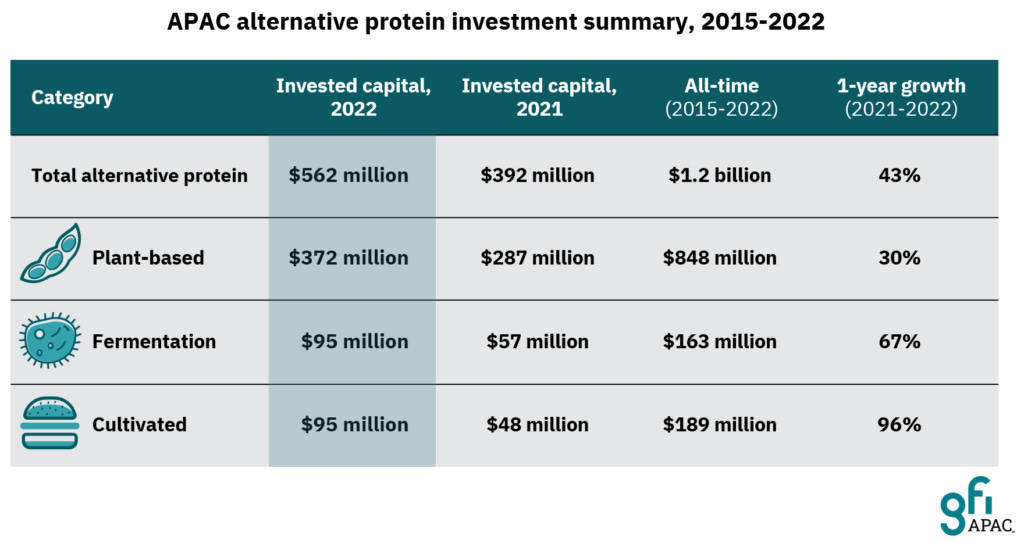

Asia Pacific has been the fastest-growing region in 2022, up 43% year-on-year to $562 million.

APAC had 19% of the global funding share, up from single digit % in the previous years.

It is a big jump, but in my view, the region is still underinvested. I often point out that over 40% of meat and over 70% of global seafood consumption is happening in APAC - and growing! We are doing our small part via Better Bite Ventures to channel more funds to alt protein startups in Asia Pacific, but much more capital is required to transform the region’s protein production and consumption.

What are industry insiders thinking about this geo shift?

Steve Molino, Principal at Clear Current Capital:

Other regions beyond the US have been lagging in innovation in alt proteins, and that is quickly changing, and investors are recognizing the influx of innovation occurring in Europe and APAC.

Sonalie calls Asia Pacific “the growth spot of the industry” and Gautam believes “the rise in APAC funding will continue as alternatives to products that are more prevalent in this region (e.g. seafood) come to market.”

And since it is my area of focus, let’s unpack the APAC funding further:

Per technology - the plant-based sector has attracted 2/3 of the funding in Asia Pacific, but fermentation and cultivated verticals are growing the fastest, up 67% and 96% year-on-year

Per country - Singapore, China and Australia got the bulk of the investment amount (29%, 26% and 22% respectively), with another 11% going to South Korea

Per deal - here are TOP5 APAC rounds of 2022:

It is worth noting that two rounds (Series As of Next Gen Foods3 and Oatside) contributed the bulk of Singapore's 2022 funding and three startups (Starfield, Changing Biotech and CellX4) to almost all of China's.

Some investors I talked to argue that Starfield's $100m Series B should rather be included in 2021 data - however, PitchBook (and hence GFI), as well as Crunchbase, place it in January '22, based on the announcement date.

China's early-stage funding is sometimes underreported by PitchBook and similar global sources. A quick cross-check with another report by a local company Assimetrics Research suggests that another $8-10m (an extra 5-7%) was invested in China in 2022 that has not been included in PitchBook data.

Albert Tseng, a co-founder of China-focused incubator Dao Foods told me about the country’s alt protein opportunity:

Yes, there are short-term challenges in consumer adoption and investor interest in alternative proteins, but we believe that the extraordinary demand for protein in China over next years provides an exciting "protein diversification" market opportunity. It is already the largest meat market in the world and some estimates have the compounded annual growth rate at 19.99% from 2023 to 2027. If you are an impact investor in alternative protein, there is no greater impact potential than catalytic investment in talented and capable entrepreneurs in China.

China's market is indeed very important and very complex - I am planning a proper deep dive for one of the next Future Food Now posts, after my upcoming trip there.

Back to the global perspective, here are the TOP10 alt protein deals of 2022 across all regions:

Last, but not least - what is the outlook for 2023?

I previously shared my survey results sourced from 35+ experts and investors as well as 100+ food tech community representatives. The median prediction from both groups has been $2.93-$2.96 billion for 2023. In other words, investors and the community believe the alt protein funding will be flat this year (more here).

Folks I asked for a comment for this article say more or less the same:

Sonalie thinks “it will be a quiet year overall with similar funding totals as last year”.

Christian also believes the figures will be “similar to 2022, as the world adjusts to changing paradigms and macroeconomic factors continue to dominate”.

Steve’s view is that “funding will remain relatively flat or possibly decrease slightly”. He also believes that “investors will focus on more reasonable deals from a valuation and deal size standpoint (i.e., the days of $10M seed rounds are gone)”.

Sharyn Murray, GFI Investor Engagement Manager, who has done great work analysing and sharing alt protein investment data, is optimistic:

As companies continue to develop new technologies, scale and optimize production to improve the taste and affordability of products, sales will accelerate and spur additional investment–particularly when macroeconomic and market conditions normalize.

So are investors already involved in this space (perhaps not surprisingly). According to late 2022 GFI’s investor survey, 87% of responders expect to make investments in alternative protein companies or funds in 2023 and 99% are optimistic about the long-term potential of the industry. And I am in both of these camps.

🎟️ Events I am attending and recommend

The Future Food-Tech Summit (San Francisco, March 16-17th) is one of the industry’s top events. I am stocked to be back, for the first time in a few years. Highly recommended - consider registering for in-person or virtual access (more affordable).

In April, I plan to go to China and do a keynote at one of the top industry events there - NewProtein & VeggieWorld. Will be great to be back now that the country has opened up for visitors. Hope to write a proper China market deep dive after that!

Caveats and limitations: the data was custom selected from the PitchBook database by the GFI team and has not been reviewed by PitchBook analysts; while PitchBook is considered the most comprehensive source of venture deal data, it is not capturing all the deals, especially in emerging markets; some startups have not disclosed the amounts they have raised or have not announced the rounds at all, these are not included; there is often a time shift between when the round happens and when it is announced publically, affecting how the deal data is recorded per quarter/year.

Sources: Alt protein - GFI/PitchBook, VC overall - CrunchBase, Agri food tech - AgFunder, Biotech - BCIQ, Carbon & emissions tech - PitchBook, Climate tech - CTVC, Fintech - TechCrunch

Disclosure: in my role as Foundering Partner of Better Bite Ventures and an angel, I am an investor in some of the companies mentioned in this piece: Next Gen Foods, CellX, Vow, Upside Foods.

Disclosure: see footnote 3.